The financial technology (FinTech) sector is revolutionizing the way Cameroonians interact with money. From digital payments to online lending platforms, FinTech is driving financial inclusion and fueling economic growth.

This transformation positions Cameroon as a burgeoning hub for digital finance in the Central African region. As we begin 2025, key trends highlight the immense potential of this industry.

Key Trends in Cameroon’s FinTech Sector

1. Growth of Digital Assets

According to recent insights from Statista, Digital Assets are projected to be the largest market in Cameroon’s FinTech sector by 2025, with an AUM (Assets Under Management) of $5.38 million.

- The average AUM per user in the Digital Investment market is expected to reach $110.10 by 2025.

- The market is forecasted to grow at an impressive rate of 11.41% by 2026, reflecting the increasing adoption of digital financial instruments.

This growth is driven by rising investor interest in cryptocurrencies, tokenized assets, and blockchain-based solutions, further solidifying the role of digital assets in the financial ecosystem.

Source: Statista

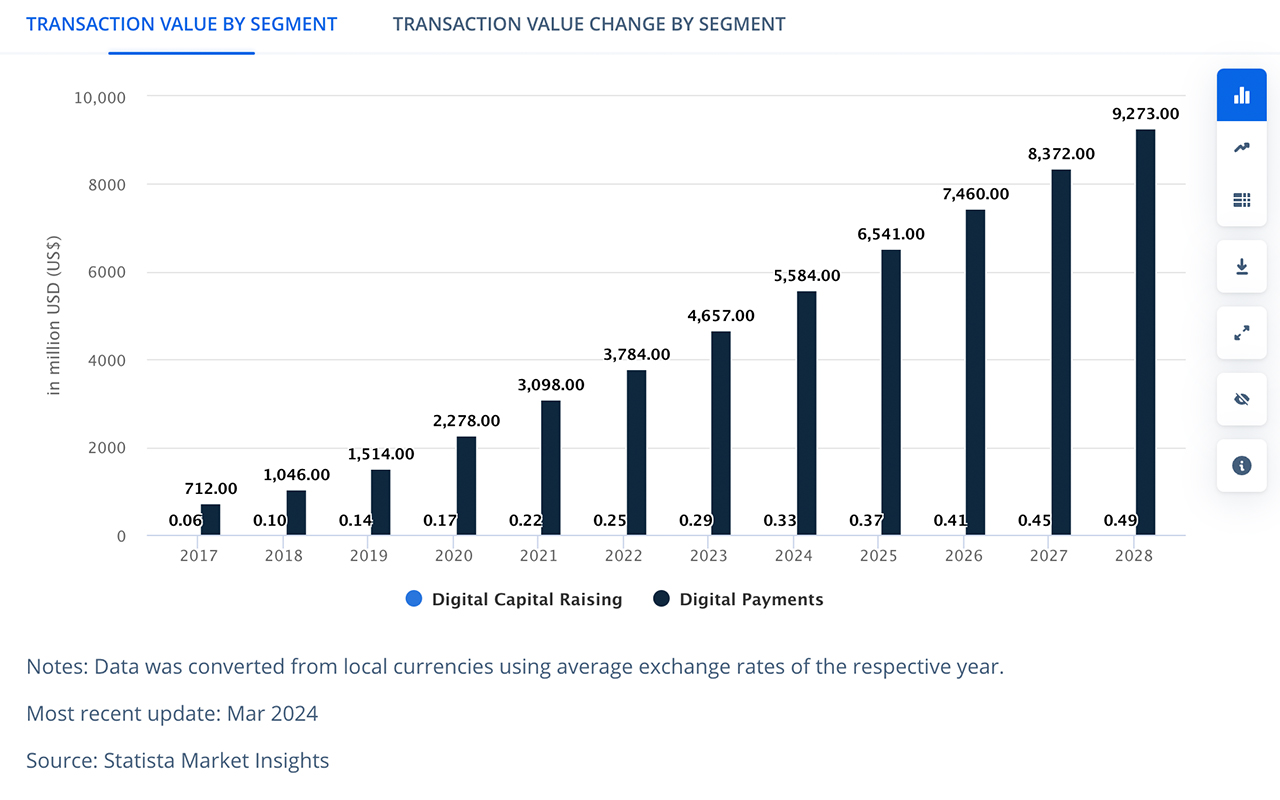

2. Expansion of Digital Payments

Digital payments remain a cornerstone of Cameroon’s FinTech evolution. By 2028, the number of digital payment users is anticipated to surpass 9.15 million.

Key drivers include:

- The widespread use of mobile money services, such as MTN Mobile Money and Orange Money, which provide accessible and efficient payment solutions.

- Integration of e-commerce platforms with mobile wallets, enabling seamless online transactions.

This trend underscores the role of digital payments in enhancing convenience, reducing cash dependency, and fostering a cashless economy.

3. Pioneering Credit Solutions

FinTech has disrupted traditional credit systems by introducing digital lending platforms like Baobab and Advans. These platforms provide:

- Simplified application processes, eliminating cumbersome paperwork.

- Quick approval timelines, enabling individuals and SMEs to access loans promptly.

By addressing financial barriers, these platforms promote financial inclusion, empowering small businesses to thrive and supporting economic resilience.

4. Innovative Players Shaping the Market

Cameroon’s FinTech landscape is marked by a diverse range of innovative companies, each contributing to financial transformation:

- Express Union: A trailblazer in mobile money, offering services like money transfers, bill payments, and mobile banking.

- Maviance (Smobilpay): A leader in digital payment solutions for e-commerce and mobile money services.

- Afriland First Bank: Championing digital banking with e-wallets, online banking, and mobile banking solutions.

- Eneo: Simplifying electricity bill payments with digital tools.

- Yoomee Mobile Money: Focusing on seamless payments for internet services.

These organizations exemplify the synergy between technological innovation and financial accessibility.

Positioning for the Future: Opportunities and Challenges

Opportunities

- Increased Financial Inclusion: Digital solutions continue to reach underserved populations, providing them access to financial services.

- Government Support: Policies promoting digital transformation are accelerating the FinTech ecosystem’s growth.

- Cross-Border Payments: Leveraging technology to streamline international transactions across the CEMAC region.

Challenges

Digital Literacy: Addressing the knowledge gap to ensure all demographics can benefit from these innovations.

Regulatory Frameworks: The need for clear, robust policies to govern the FinTech space and protect consumers.

Dakidarts: Leading the Conversation in FinTech

At Dakidarts, we are committed to being thought leaders in Cameroon’s evolving FinTech landscape. By exploring emerging trends and fostering conversations around digital finance, we aim to empower businesses and individuals with actionable insights.

Conclusion

The rise of FinTech in Cameroon is a testament to the country’s resilience and adaptability in embracing technological advancements. With projected growth in digital assets, payments, and lending, the sector is poised to redefine the financial landscape.

As we look ahead to 2026, Cameroon’s FinTech ecosystem offers immense potential to enhance economic inclusion and innovation.